Valid extension can also be close to 1.272 and higher than 1.272.Optionally, the time to complete retracements A and B should be equal.Drive 3 should be the 1.272 extension of correction B.Drive 2 should be the 1.272 extension of correction A.Point B should be the 0.618 retracement of drive 2 optionally 38.2 - 88.6%.Point A should be the 61.8% retracement of drive 1 optionally 38.2-88.6%.Past performance is not necessarily an indication of future performance. This pattern is known to be one of the foundations for Elliot Waves.ĭepicted: MetaTrader 4 - AUD/NZD 4 Hour Chart - Three Drives Pattern - Disclaimer: Charts for financial instruments in this article are for illustrative purposes and does not constitute trading advice or a solicitation to buy or sell any financial instrument provided by Admirals (CFDs, ETFs, Shares).

The three-drive pattern is a lot like the ABCD pattern, except that it has three legs (now known as drives) and two corrections or retracements. This pattern is a strong day trading with short-term price pattern, but it is also used as a swing trading pattern. It signals that the market is exhausted, and that a reversal is likely to happen.

#Abcd trading pattern series#

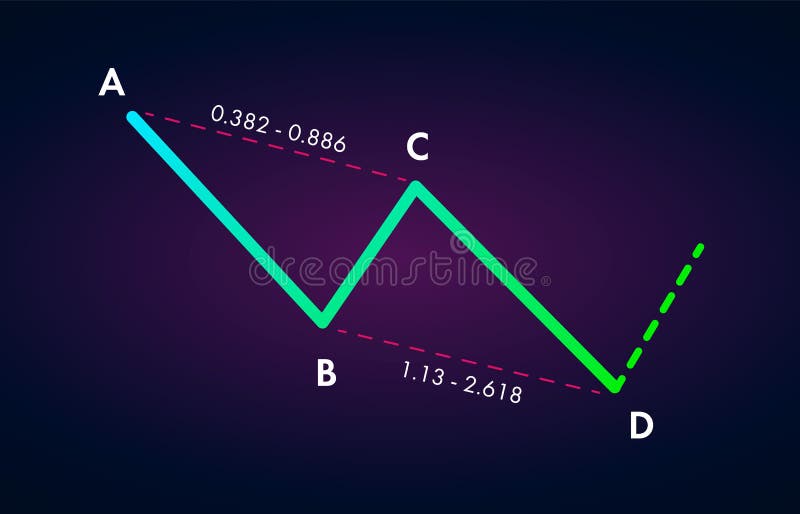

The Three Drives pattern is a 6-point reversal pattern characterised by a series of higher highs or lower lows that complete at a 127%, or a 161.8% Fibonacci extension. Optionally, the time it takes for the price to go from A to B should be equal to the time it takes for the price to move from C to D The Three DrivesĪ graphic illustration of a Three Drives trading pattern Retracement followed by an extension suggests a higher probability for another retracement to occur. Additionally, one of the best performing ABCD patterns is AB=CD, whereby the length of the AB line should be equal to the length of the CD line. We need to use a Fibonacci tool on leg AB (from left to right) and then we will get a BC retracement level. AB and CD are known as legs, while the BC is known as a retracement (correction). These points define three consecutive price swings, or trends, which make up each of the three pattern "legs." These are referred to as the AB leg, the BC leg, and the CD leg.

Past performance is not necessarily an indication of future performance.Įach turning point (A, B, C, and D) represents a significant high or a significant low on a price chart. It is the basic and simplest Harmonic pattern, but is nonetheless a very effective one.ĭepicted: MetaTrader 4 - AUD/USD 4 Hour Chart - ABCD Pattern - Disclaimer: Charts for financial instruments in this article are for illustrative purposes and does not constitute trading advice or a solicitation to buy or sell any financial instrument provided by Admirals (CFDs, ETFs, Shares). It can be identified on any timeframe, and can be seen in the formation of other advanced patterns. The ABCD Pattern was designed as a day/ swing trading strategy. This is one of the best performing day trading patterns in the world of Forex. We will discuss simple and effective Forex patterns that have been proven to work throughout Forex trading history. There are multiple trading methods that make use of these patterns in price to find entries, targets, and stop levels. These patterns make use of peculiar market movements, and highlight the chart with different price structures which traders use to trade with. The key principle of any Forex trading is to keep trading simple. This article will discuss the importance of trading patterns, and it will investigate several trading patterns in detail, such as the ABCD pattern, the Master Candle, the Three Drives pattern, and more!įorex patterns are the core of successful price action trading.

#Abcd trading pattern professional#

This article will explore some of the key Forex patterns that every professional trader should know about.

0 kommentar(er)

0 kommentar(er)